Want to be a Millionaire? was contributed by guest author David Davis.

Do you want to be a millionaire? Not everyone does; but nobody wants to be poor. We would all like to lead a life unburdened by constant, crushing financial stress and worry. Financial strain hurts many people, and not just emotionally. Financial anxiety over a long period can cause physical problems. It can damage and even destroy relationships and families.

Some of us are having a hard time financially. We are not sure how to make it to our next payday. We are thinking survival, not getting wealthy. Many of us have been in that situation at some point. This article is not for you right now. Focus on survival. Once things are better, come back to this article again and think about getting wealthy.

There are a few keys to being financially secure, even well off. The problem is that these keys do not come up in most schools. They do not pass down from most parents to their children. The keys are not secret. You will probably recognize some if not all of them. I did not invent them. Instead, many, if not most, experts and financial advisors agree with these keys to financial security.

If you want to be a millionaire, or whatever you consider to be wealthy, there are really only two ways to do it. One way is to apply the following six rules. The other way is to inherit a fortune. If you do not have a rich uncle, the following six rules are your best shot at attaining financial security and even wealth. The six rules are:

- Make More Than You Spend

- Pay Your Taxes and Debts

- Borrow Carefully and Infrequently

- Save and Invest

- Start Early

- Make Your Money Work

Before we look into each of the six keys to wealth, we need to discuss what wealth is. The measure of your wealth is called your net worth.

You Want to Be a Millionaire? Have a Millionaire’s Net Worth

Wealth is a net-worth that equals some number that you consider high enough to make you feel secure. For example, If you want to be a millionaire, you need a net-worth of $1,000,000.

Many people do not understand how to measure their net-worth. Net-worth equals what you own minus what you owe. Assets minus liabilities. Your assets include your money (in your pocket, in your bank account, and in investments.) Other assets include things of appreciable monetary value (your home, other real estate, and for people who have them, pensions.) Your liabilities include all your debts and obligations. This is all the money you owe to others in loan repayment (including credit card balances,) taxes and any other commitments.

Make More Than You Spend

Many of us struggle with this rule. Sure, it seems obvious that to attain any level of wealth you must make more than you spend. Nevertheless, many of us live from paycheck to paycheck without putting any of our income away. Decisions made early in life often determine how we will fare with this most fundamental key to wealth. These decisions include:

Who and When we Marry

This decision has a bigger influence over your financial future than any other life choice. Choosing a life partner who shares your goals and aspirations is crucial. In addition, timing plays an important role in your financial future. People who never marry tend to be wealthier than married people. Those who marry later tend to be wealthier than people who marry in their teens or early twenties. Finally, people who experience divorce are less wealthy than people who stay married.

How Many Children we Have

The fewer children we have the wealthier we become. Children may be gifts from God, but they are very costly all the same.

Where we Live

We all want to live in a palace. Few of us can afford a palace without being “land rich and cash poor.” Buying a house is the best opportunity most of us have to build wealth. But, buying a house too early in life, before you are financially equipped, can cripple your budget. Spending too much on housing can prevent you from having money to save and invest. Taking on a big long-term mortgage you cannot afford can lead to bankruptcy. Want to be a millionaire? Don’t try to live like a millionaire until you can afford to.

What we Drive

The “new car smell” can be seductive, but it is dangerous for your financial future. Our vehicles are usually our second largest debt (behind our home mortgage.)

Our Student Loan Debt:

The price of a good education has risen sharply during the last few decades. Getting a good education is vital to becoming wealthy. A college degree is associated with higher incomes and larger net-worth. Consider ways to economize on college expenses. Community colleges are often a great value for the first two years of college. A local public university can be a more economical choice than a far-away “prestige” school.

What we Spend Money on

Control your spending. It sounds obvious but requires a lot of self-discipline. Experts advise that you consider every purchase to determine “Is this something I need?” If the purchase is not necessary, consider “Will this really make me happy?” Then ask yourself, “Will not having this really make me unhappy?” If you have decided to make the purchase, you have to ask yourself, “Can I afford it?” If you cannot afford the purchase and you plan to charge it on a credit card, you must ask, “Do I want to pay for this twice?” Because, if you charge the purchase and make the minimum payments, you will end up paying double the price.

Pay Your Taxes and Debts

Pay these obligations and pay them on time. Evasion of taxes will result in additional costs, seizure of property and possibly other legal penalties. Late debt payments will wreck your credit rating, making it progressively more difficult and expensive to borrow money and rent an apartment. Paying your taxes and debts on time will save you money, and make your life easier. For example, here is a dirty little secret. People with good credit do not have to pay interest on credit card debt. Banks constantly offer these people credit cards with one or two years of zero interest.

Borrow Carefully and Infrequently

If you have good self-discipline and carefully consider your purchases, you will minimize your need to borrow money. Be aware of the long-term costs of paying interest. Many young people fall into dangerous spending habits when their first credit card arrives. They can spend years trying to recover financially. Many older people find themselves addicted to on-line shopping or gambling habits that lead to crippling debt.

Save and Invest

You cannot grow wealthy if you keep your money in a checking account or stuff it in a mattress. Wealthy people invest. For most of us, the easiest, most foolproof way to invest is via payroll deduction. Have your employer deduct some money from your paycheck for deposit into a retirement investment account. You can have this arrangement done “pre-tax” to reduce the amount of income tax you have to pay now. You will still have to pay taxes on the money when you withdraw it but you do not pay taxes on the interest you earn; it is yours to keep.

The problem with foolproof schemes is that some fools can find ways to sabotage them. If you try to take money out of retirement investment before retirement, you will have to pay a penalty. The way to avoid sabotaging your investments is to save some money each month in a savings account. This money is liquid; you can use it whenever you need to. When you must use saved money in an emergency, at least you will not sabotage your long-term wealth.

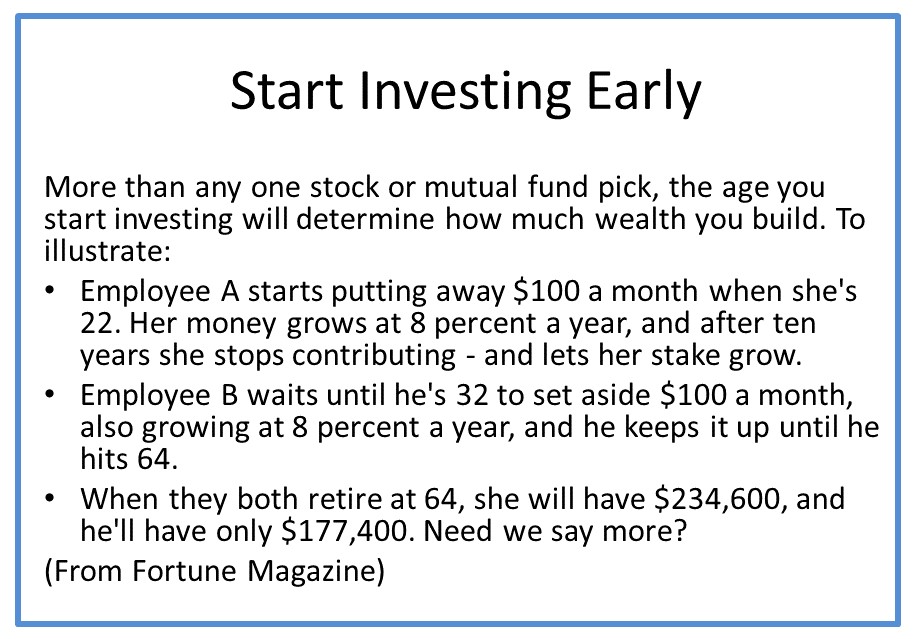

Start Early

Timing is important. Money invested in the first ten years of a young person’s career can produce greater wealth than the same amount invested every ten years for the rest of their careers. Also, form good spending and debt control habits early in life.

Make Your Money Work

Wealthy people do not become wealthy because they have high paying jobs. They are wealthy because they have money working for them all the time. Moreover, the money that is produced by their money working for them? It starts working for them too. It works for them even while they sleep. Want to be a millionaire? Do what millionaires do.

How can you make your money work? There are many investment experts providing every kind of advice imaginable. Over a long period of time the Standard and Poor’s index has performed as well or better than most professionally managed funds. The Standard and Poor’s 500, or simply the S&P 500, is a stock market index tracking the stock performance of 500 large companies listed on exchanges in the United States. If you do not have an investment strategy you have reason to believe will do better, invest in an S&P 500 index fund. According to Fortune Magazine, “Even the best fund managers have trouble beating the S&P 500, so give up the chase.”

One good free source of unbiased investment information and advice on-line is investopedia.com

Still Want to be a Millionaire?

Nobody else can tell you how wealthy you need to be. If you are happy with what you have, you are probably wealthy enough. Some of you are asking, “I am not in my twenties any more. Is it too late to start becoming wealthy ?” The answer is “No, it is never too late.”

Want to be a millionaire? Recognize the challenge ahead and start applying the rules. You will become wealthier than you would have been if you never started at all.

For those of us who are middle aged or older, share this article with younger people you know. I based this article on a lecture I used to give to seniors in College. The vast majority of my students had not heard any of this advice before. If you want to give your children or grandchildren a better chance to be wealthy, pass this advice along to them.

Related Articles: Simplify Your Life, How to Simplify